Revisiting Reducing Pet Costs: Why I Love Pet Insurance

As we noted last week (and elsewhere), pets can be expensive. The daily expenses of food, treats and toys though are dramatically eclipsed by the terrible vet bills. They seem to come at any time and can be ludicrously expensive. So, what to do?

As we noted last week (and elsewhere), pets can be expensive. The daily expenses of food, treats and toys though are dramatically eclipsed by the terrible vet bills. They seem to come at any time and can be ludicrously expensive. So, what to do?

First, a little story

Once upon a time, I didn’t have a dog. Instead, I had a roommate with a pet. This pet managed to chip his tooth, resulting in an infection in one tooth and an abscess in another. Fixing the problem? Both teeth would have to be pulled and the pet needed additional antibiotics to control the infection. The cost? Nearly $1,600, which was bargained down to an only marginally less ridiculous $1,300. All to pull two teeth.

Fast forward

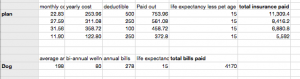

I now have my own pet and the experience of my roommate had made a huge impression. Because of my dog’s diet I now brush his teeth regularly, but I began to investigate the cost of insurance. But first, I crunched numbers. Poking around on the internet, I tried to approximate the average cost of vet visits per year, which I bench marked at $200 based on Consumer Reports articles on Pets. And of course from experience I knew that there could be statistical outliers that would play havoc with a budget. Because my dog’s vet worked closely with VPI, I decided to check out their policies. This is what I came up with (based on the options available and pricing at time of purchase):

[Explanation: These numbers are for dog policies. The average annual bill I listed at $198, just below the $200 given by CR. The total cost of two wellness checkups at approximately $40 each was $80, which added to the original vet cost of non-wellness related procedures and multiplied by approximate life expectancy yielded the final number. Though not included in the column, the cost of non-wellness related vet visits was calculated to be $2,970. This number does not include expensive continuing treatments such as doggie dialysis or chemo.]

Given my dog’s relatively young age, I didn’t expect any of the big expenses (cancer, renal failure) but was worried about dental health and panic moments–the times where something scary and expensive happens and I wanted to know I wouldn’t be massively in debt because I was taking care of my furry friend.

Why the numbers aren’t that important

First off, by paying annually I essentially got one moth free, so a discount of between 10 and 30 dollars. Secondly, the numbers were an approximation meant to give me an idea of what type of expenses and what the benefits were of each policy. As you can see, the total insurance paid varies greatly over the lifetime of the policy and so a few dollars here or there is relatively insignificant. What I concluded was that for the insurance most appropriate to my dog (“trauma” insurance covering dental problems, bites, accidents and foreign body ingestion) was relatively comparable to the cost of not having any insurance, however if there was a single significant trauma (like my roommate’s pet experienced) every seven or so years the insurance policy would be well worth it. Additionally, I anticipate more expensive vet visits as my dog gets older and potentially develops serious and chronic problems. When he becomes an older dog, I will switch to a more expensive policy that will cover the different treatments that aren’t covered by his current policy.

The result?

Nearly a year after my roommate’s pet’s issue, my dog broke his tooth and needed to have it extracted. The initial check up and medication got him to his deductible leaving 4/5 of his bill covered by insurance to the tune of $398.58. Additionally, like Consumer Reports suggested, shop around. It helps. Though I was reimbursed I still had to pay up front initially and was able to find a vet that did the surgery for substantially less than I would have paid otherwise.

Here’s a screen shot of my portal for managing Buddy’s insurance, with a breakdown afterwards.

Less than a month later he found a pork bone on a walk and ingested part of it before I could stop him, causing him to vomit blood. This round of insurance didn’t go nearly as smoothly as the first submission, since I found out that first, his vet had submitted the wrong claim, then it was denied because they couldn’t read his vet’s handwriting. However, after talking to the vet and disputing the claim, Buddy’s insurance company payed out $325 of the original $378.25. Though it took more time, not having to pay that $325 was worth it. It’s important to remember that just because a claim was denied doesn’t mean you might not get reimbursed. Follow up. Be persistent. (More on this later) You’re paying them money to make sure your pet gets coverage, which means sometimes you have to be a nuisance. Additional take away? Know what your policy covers and make sure it is referenced in the vets notes. Foreign body ingestion is covered by my dogs policy, but vomiting is not. Part of clarifying the vet’s notes was making sure that the mention of the masses in my dog’s GI track where included in what was submitted, making the difference between what was covered and what wasn’t.

Overall, for $112 a year, $714.18 out of $1,119.93. The deductible for the policy was $250, meaning that of the 869.93 I was eligible for, I was payed back for 82.1% of what I submitted. Not too shabby. I pay out of pocket for vaccines and wellness check-ups, but only because my analysis indicated that with the difference in premiums, it would cost more to pay for the higher level of insurance than it does to pay out of pocket.

The total payout means he can go another 7 years without having an issue and it will translate to roughly breaking even. Knowing his penchant for mischief, while I hope he can manage that long without making me worry I certainly don’t anticipate it. Especially given that he has been attacked by other dogs three times and while he is fortunate enough to not have been injured beyond minor puncture wounds, it’s good to know that , my dog has three times been attacked by other dogs. Had any one of these been severe enough to cause significant trauma, these attacks would have been covered as well. Even if your dog or cat is a little angel–as I’m sure most pet-owners believe–external factors can’t always be controlled. Another example? One of my dog’s little friends had to had orthopedic surgery to repair tendon damage, to the tune of several thousand dollars. Another situation where it’s great to have insurance so you can recoup some of the initial expenses.

Now, these results may not be typical since I live in an area where vet costs are high but when an emergency came around I was able to focus more on taking care of my dog and less on how I was going to pay his bills. Though I never anticipated his tooth or his stomach problem, I was able to create a safety net for myself using a combination of my emergency funds and his insurance. (The process of submitting a claim and then waiting for a check can take about a month.) As a bonus, when I pay my dog’s bills on my credit card and then am reimbursed I get to keep all of the points I accrued as a result. Huzzah!

A final thought

A number of people have concluded that they have had the best results with simply allocating a portion of each pay check to pet care costs, using a targeted savings account. (For more on this, check out Clint’s “How To Build a Budget.”) I have found that even with insurance there is a place for this. My dog’s insurance covers big expenses while I handle the smaller expenses (vaccines and routine visits) with targeted savings accounts. For some people whose dogs are predisposed to issues such as hip dysplasia, pet insurance can be particularly valuable though proportionally more expensive. Cost benefits vary based on the size, age and breed of dog. Resources such as Consumer Report articles and Insurance calculators can help you crunch numbers and determine if it’s worth it for your pet. There are a number of articles that dismiss insurance in favor of emergency funds and targeted savings accounts, but constructing for yourself a long term cost/benefit analysis can remove the guesswork of determining whether or not pet insurance will work for you.

Finally, in full disclosure I in no way benefit from extolling the benefits of pet insurance other than knowing that people will be more likely to be able to keep their furry family members after an emergency than they might be able to otherwise.

Way to break it down, Elizabeth. Some friends of mine had to give their cat dialysis for a while, and ended up $4000+ in debt because of it. After that little fiasco, I became convinced that pets – especially seniors – need to have insurance. Now if only I could get insurance for myself . . .

P.S. Is that your little buddy in the photo? ADORABLE!

Thanks Serena! My parents are both engineers, so spreadsheets are just how I roll. Especially since I can’t visualize stuff like this in my head. It’s also much more reliable to have numbers rather than a general sense of what the numbers should be.

And yes, it’s such a shame that it’s so much harder for humans to get insurance and then get reimbursed for expenses. It’s one of those things I can’t talk to much about without getting incredibly angry.

And yes, that’s my little buddy princess on the day he came home from the shelter. He’s definitely the Buddyiest buddy of all the buddies. He’s pretty great.

Can you recommend a few names of pet insurance companies?

Rick,

I used VPI and have been pretty pleased with it (as you can see). I have a vet tech friend who suggested Trupanion as an alternative. From what I can read of their policies they look like they could also be a good company. Those are the two that I’m aware of but I’d say do some research. The type of insurance you get is also contingent on your type of pet and the issues it’s prone too.