The Gold Star Portfolio

“The next thing I say to you will be true. The last thing I said was a lie.” — Devo

Two weeks ago, I wrote about my Three-Minute Portfolio based on low-expense-ratio index funds. That’s a great way to put your investments on autopilot. However, an index fund, by definition, will never beat the market.

If you’re willing to put a little time and attention into your investments you can make a portfolio that will (probably) do a bit better than the market.

Didja’ notice some wishy-washy words in that last sentence?

- “Probably”: No one can guarantee you returns that beat the market. Anyone who does is related to Bernie Madoff.

- “A bit better”: This is not a get-rich-quick scheme, it is a way to consider other sensible investments.

That being said, it is reasonable to consider what you would choose if you want to reach a bit beyond index funds.

A sensible place to look is to use Morningstar’s rating system. They rate all mutual funds from one to five stars. The worst 10% of all funds rank one star, 22.5% rank two stars, 35% rank three stars, 22.5% four stars, and the best 10% rank five stars. The funds are grouped by category (e.g. US Large Cap) and adjusted for risk.

The following tables list mutual funds that:

- have an overall Morningstar rating of five stars,

- have a five-star rating for the last three, five, and ten-year periods,

- are no-load funds,

- require less than $3,000 initial purchase,

- average tenure of the fund’s managers is greater than five years,

- have >$100M in assets,

- are open to new investors, and

- are available at either Schwab, Fidelity or E-Trade for no transaction fee (NTF).

Note that I didn’t include expense ratio as one of the criteria. High expenses make it difficult to outperform peer funds, so five-star funds typically have low expense ratios.

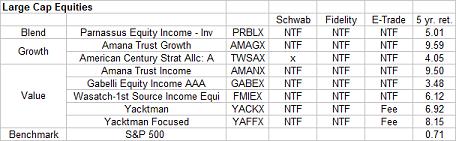

Large Cap Equities (US)

The following eight funds met the above criteria and handily beat the S&P. The five year annualized return is included in the last column. The benchmark S&P 500 index returned 0.71%, while the average for this group of eight is 6.6%(!). That’s beating the benchmark by 5.9%. Over 5 years, that’s a difference of 33%!

NTF means “no transaction fee,” and “x” means not available at that particular brokerage.

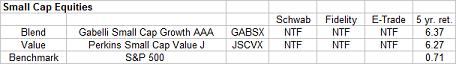

Small Cap Equities (US)

The next table shows the two best performing funds available. No small cap fund fulfilled all of the above criteria. The following two met all but one criterion: the ten-year star rating is four, not five, stars. That’s still an admirable showing considering there are 2,066 small cap funds available.

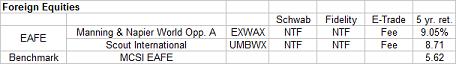

Foreign Equities

There are two foreign equity funds that made the grade, though both have a fee charged if purchased through E-Trade.

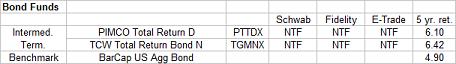

Bond Funds

There are two bond funds that also made the cut. Note that they only beat the benchmark by a bit more than 1%, but that’s still pretty great (especially for a bond fund.)

Here is the performance chart for the Gold Star Portfolio over the last ten years (Click on it to make it larger). It assumes the same asset allocation as used for the Three-Minute Portfolio: 45% US Large Cap (AMAGX), 15% Small cap (JSCVX), 15% Foreign (UMBWX), 20% Bonds (TGMNX), and 5% Cash. (For those of you into such things: the weighted alpha of the portfolio is 5.03, the weighted beta is 0.7, and the weighted expense ratio is 1.08%.) That’s a pretty rockin’ portfolio.

For comparison, here’s the performance chart for the Three-Minute Portfolio over the same period:

Give me one good reason I shouldn’t use the Gold Star Portfolio:

Better than that, I’ll give you three:

- Past performance does not indicate future performance. This portfolio is developed in 20-20 hindsight. Granted, ten successful years is a very good record, but it doesn’t guarantee that they won’t screw up on the eleventh.

- Fund managers can change. You need to keep an eye on these funds, if only occasionally. Actively managed funds (as opposed to index funds) depend on the abilities of the manager. If he/she changes, it may affect the overall performance.

- Each of these funds may have just gotten lucky. Let’s say there’s a 50% chance in any given year of beating the benchmark. (It’s not really that high, but it makes the math simpler.) Beating the benchmark ten years in a row is like flipping a coin ten times and getting all heads. It’s possible, but highly unlikely. In fact the odds are 1 in 2 to the 10th power or 1:1024. And if you’re a careful reader, you’ll remember that for the small cap funds I recommended 2 out of 2,066. Hmmm. Rather similar odds.

Alternatives:

The 50/50% strategy. Instead of putting all your eggs into the Gold Star basket, you could choose to put 1/2 into index funds and 1/2 into Gold Star Funds. That may reduce the worry for you, and still give your portfolio some oomph.

The training wheels approach. You might start off with an index fund portfolio, but choose to make new additions to Gold Star funds. This might be a good approach if you’re new to investing.

Summary:

No one can predict the future of the financial markets. There are no guarantees. There are educated guesses. A ten-year five-star Morningstar rating is about as good a predictor as one can hope for, but it is not perfect. Good luck with your investments. I’d love to hear your feedback on these suggestions.

Related posts:

Disclaimers: This information is provided for educational purposes only. It may not be an appropriate investment for you. Learn all you can about investing before plunking your money down. Investments in mutual funds are not FDIC insured and can cause loss of principal. (You can lose money).

By day, Helen engineers new materials to make computer chips cheaper, better, and faster. When the son goes down (pun intended), she writes about personal finance at Affine Financial Services.

Leave a Reply