The Moneyshot: Day 1

So here’s my secret that I’ve never shared with any of you. Although I’m your friendly neighborhood gay financial blogger, I am also in debt. Last year I was largely unemployed so I racked up a healthy amount of debt to the tune of $13,000. Seems like a lot? Yes, it is. It is an awful lot to have hanging around my neck. It ties up’“in minimum monthly payments alone’“about $250 of my hard-earned cash, and then I have to pay extra if I ever want that debt gone.

For the first time ever, I’m going to lay my financials in front of all of you in the hopes that I can inspire you to pay your debts off. I have had to do this before, but I always had student loans or something else in terms of a windfall to help me pay my cash off. Instead of doing all that, I’m going to have to pay my debts down the old-fashioned way, penny by penny, bit by bit. I will not stop doing these posts until I’ve paid the entire thing off. And in the process, I hope to help enlighten you guys as to how it’s possible.

It’s my dark little secret too, because I didn’t feel like I should share it. I felt like as a financial advisor (of sorts, I guess) that I should not talk about my own debt. But you know what? I have my own toolbox of skills here, and I’d hardly be a good teacher if I didn’t show you how to use them. I also want to show you that this can happen to ANYONE, and that the only way to get out is by the bootstraps.

My monthly income clocks in at roughly $2,000 a month after taxes. After rent, minimum credit card payments, and all my other expenses, I’m left with around $500 a month to play with. Rather than play with that, I’m going to throw all of it at my debt. In lieu of fun money, I’m going to just have to earn more. That means I’ll be blogging more, taking on other freelance projects, and even cooking up schemes to make more money. Literally, in fact. I’ve started baking for a little extra cash.

Challenge #1: stop spending on wants

I’ve set up a spreadsheet for myself to stop spending money on things I don’t need. Right now, my spending is out of control. I stopped budgeting last month and since I’ve spent more money on going out and things like that than I have in a long time. I’m going through something of a second adolescence right now, which is fine, but I need to be somewhat responsible while doing it. I’m running the risk of running out of money right now, because I have $60 to my name until Friday.

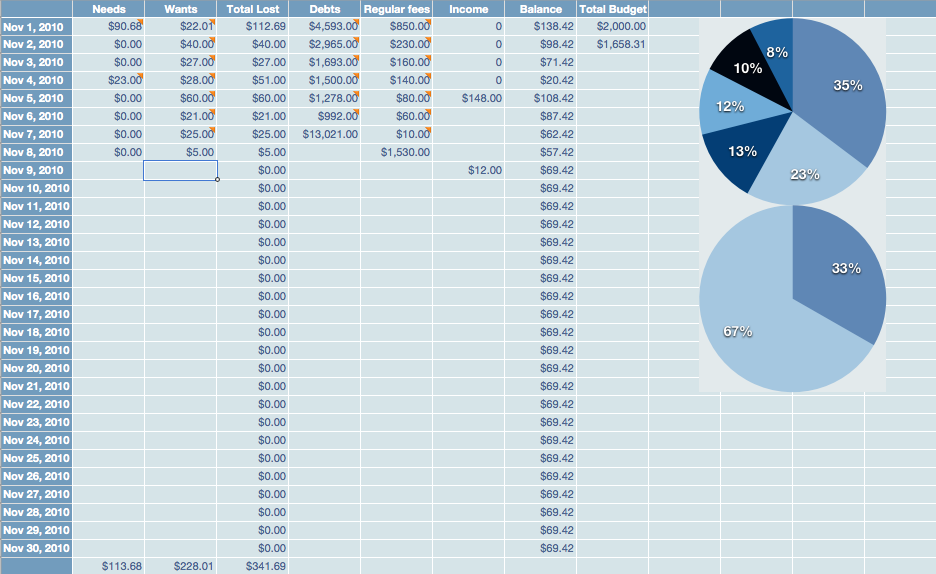

Here’s a quick snapshot of the month:

If you’ll notice, a full THIRD of my spending right now has gone to wants, not needs. Not only that, but only one of those was an actual social gathering. The rest were just lunches for work, games, and other things I really don’t need. That’s all money that could have gone to my debt’“gone. My goal is to realign the balance. I should currently be spending zero on wants. My extra income should take care of that. So that means that this month, I need to make $2,228.01 just to make up for the money I already wasted.

I’m doing this to publicly motivate myself as well, so if you have any comments you’d like to leave, I’d love to hear them. This is new territory for me, so let me know what you think!

Bravo, Clint, for owning up to your predicament. In the current economic climate, there are so many of us in the same boat.

I’m sure that you already know this, but my one piece of advice would be to find out the interest rates on all of your debts and focus on paying off the highest interest rate debt first. Once you pay off that debt, roll that amount down to the next debt, and so on.

CNN Money has an AWESOME debt calculator that helps you figure out how much you need to pay on each debt, and how long it will take you to get out of debt. Here’s the link:

http://cgi.money.cnn.com/tools/debtplanner/debtplanner.jsp

Best of luck, Clint! I’ll be interested to hear your progress reports.

Thanks Serena! I’ll be doing them weekly. And thanks for the calculator!

Clint, I had a similar problem several years ago. My credit card debt was building up with dinners, new furnishings (I just bought a house), etc. How I paid down my debt was I put extra money towards the bill with the highest interest rate. Once it was paid off, I took that money (plus the extra money) and put it towards the next bill. I also kept a spreadsheet that showed how much these balances were going down. It was a great motivation to keep going. I paid off my credit cards, JC Penny, Sears, etc. in about two years. Good luck!

Hi Clint,

My partner and I are embarking on the same journey, starting today. We have let it go too long (wants vs. needs) and need to make a change. Good luck to all of us!

Thanks Kurt. Right now I’m sort of dealing with anger at myself for spending so much and also the fact that it’ll take so long, but it is what it is. I’ve got to focus or I’ll have this albatross around my neck for years longer than I want it!