The Stock Investor: An Analysis of Google. Part One.

Using part of my meager stock budget, I bought two (yes, TWO) shares of Google on December 16, 2008. Price – $334 per share ( including purchase and eventual selling fees.)

Using part of my meager stock budget, I bought two (yes, TWO) shares of Google on December 16, 2008. Price – $334 per share ( including purchase and eventual selling fees.)

On Jan 20th, 2009, the stock fell to its lowest since my purchase, $283 (-15%.)

And Monday, February 9th, 2009, about 2 months since I purchased it, Google hit $379 (+13%.) Tuesday, it fell to 358 (+ 7%) in a very sad bear market. What’s the point here?

The point here is that William O’Neil – founder of Investor’s Business Daily (IBD) – advises selling any stock whose value falls to 8.5% below the purchase price. That means I should have sold at my selling point of $305 (- 8.5%.)

Great advice in a normal market.

But, ok, we all know that today’s market is far from normal. Dramatic daily market fluctuations are the norm, and I could needlessly increase my losses following this advice.

So I asked myself, “Self, what is this telling me?”

The answer came screaming back:

It ain’t black and white, Sherlock!!”

I need to know my stocks.

Here’s at least some of what I need to know about Google.

1) It’s sound technically.

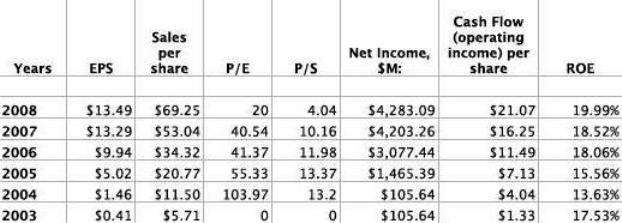

Let’s analyze what the this data means.

A) Earnings per Share (EPS) – by definition, for growth companies, it should have gone up in each of the last 5 years. Check.

B) Operating Cash Flow per Share – should be increasing for the last 5 years. Check.

C) Sales per Share – should be increasing for the last 5 years. Check.

D) P/E – should be dropping. Check.

E) P/S – should be dropping. Check.

F) Return on Equity (ROE) – Desire ROEs of at least 20% maintained or improved over the yrs. If you’re bargain hunting, you might accept a low or neg. ROE from time to time. A steady ROE indicates a continuing return of substantial profits to investors. Almost Check.

So far, Google is looking good. In part two of this article, we’ll discuss other important parameters, such as volume, institutional and insider ownership, and the beat on the street.

Stay tuned.

Any thoughts out there on this stock? Any one own some shares right now, or thinking of buying some?

photo credit: PicApp

Lisa: This is a timely topic for me as I’m planning to review Howard Lindzon’s new book The Wallstrip Edge next week. He looks at trends in order to know when to buy, when to hold and when to sell… I think you would enjoy the book!

Can’t wait for part two! I’ve been meaning to learn all about buying individual stocks (versus just mutual funds), and it’s awesome to find a complete breakdown and explanation of everything.

Just a quick question – is the purpose of you buying stock for a quick turn-around or for a long-term investment? If it’s for long-term, wouldn’t you want to re-evaluate when to sell in longer increments (maybe every six months – year) rather than monthly?